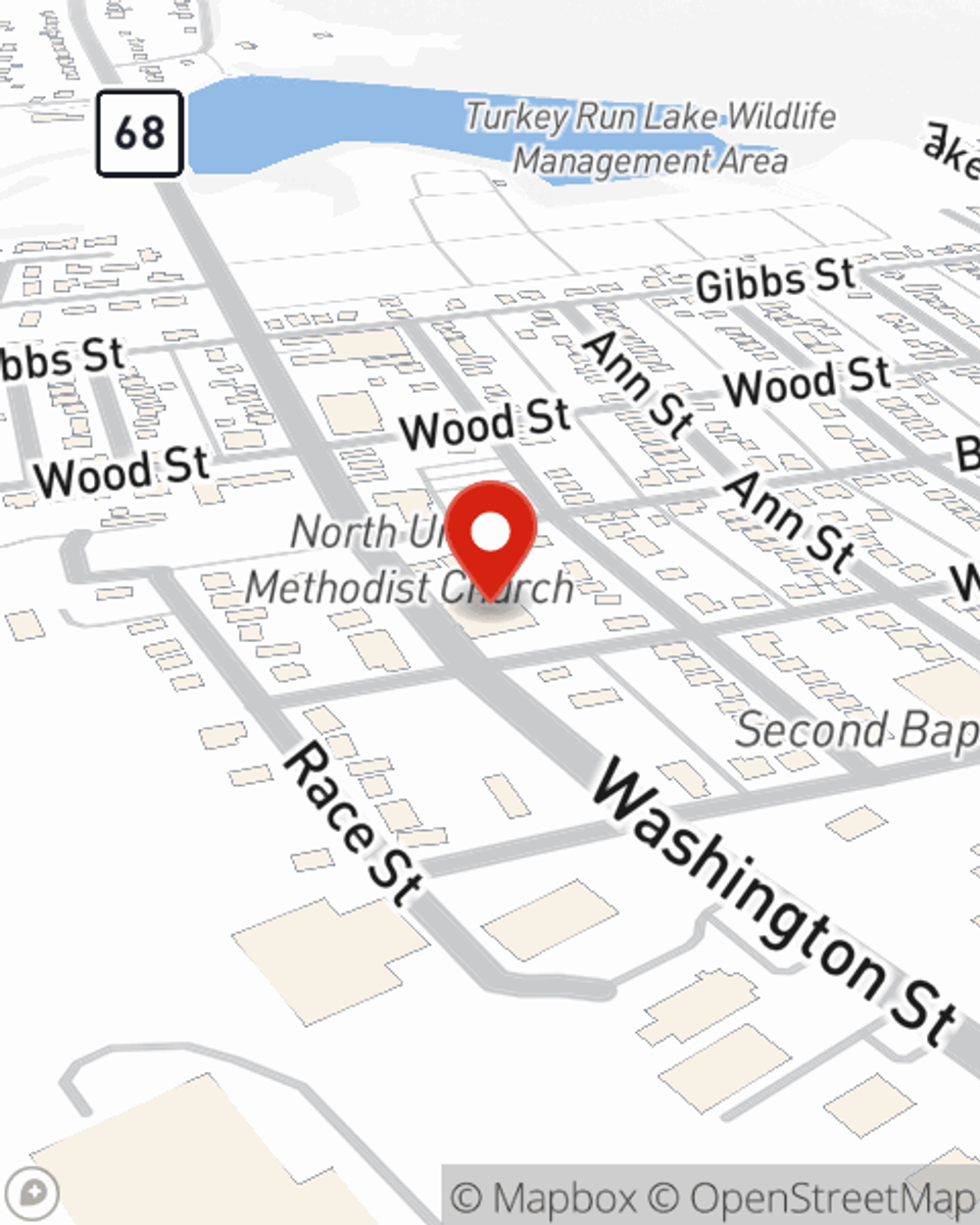

Insurance in and around Ravenswood

A variety of coverage options to help meet your needs

Customizable coverage based on your needs

Would you like to create a personalized quote?

It’s All About You

Your family and your belongings are some of what's most important to you. It's natural to want to protect them. That's why State Farm offers great insurance where you can develop a Personalized Price Plan to help fit your needs.

A variety of coverage options to help meet your needs

Customizable coverage based on your needs

Got A Plan? Let Us Help You Get There

Some of these excellent options include Renters, Business, Condo and Life insurance. Not only is State Farm insurance a great value, but it's a smart choice.

Simple Insights®

Tips to help prevent burglary

Tips to help prevent burglary

Consider these home burglary prevention ideas to help protect your home.

State Farm® mobile apps to download today

State Farm® mobile apps to download today

Put your tablet or smartphone to work with apps that make it easier to manage your insurance, help new drivers build skills and offer feedback on your drive time.

Tyler Shank

State Farm® Insurance AgentSimple Insights®

Tips to help prevent burglary

Tips to help prevent burglary

Consider these home burglary prevention ideas to help protect your home.

State Farm® mobile apps to download today

State Farm® mobile apps to download today

Put your tablet or smartphone to work with apps that make it easier to manage your insurance, help new drivers build skills and offer feedback on your drive time.